What is the bitcoin supply schedule?

The pre-programmed pace from zero to 21 million

The Bitcoin supply schedule is the preprogrammed pace at which bitcoin are issued into circulation.

This schedule began at zero when Bitcoin was launched on January 3rd, 2009 and is steadily progressing towards the terminal supply limit of 21 million bitcoin in the year 2140.

When Bitcoin was launched as peer-to-peer electronic cash, there needed to be a way to distribute the bitcoin into circulation. The solution to this challenge was to pair bitcoin distribution with the processing of transactions, in a system commonly called “Bitcoin mining”.

Mining is the process whereby computers compete in successive lottery-style competitions to win the rights to add the next block of transactions to Bitcoin’s blockchain and get paid a bitcoin reward for doing so. That bitcoin reward comes in two parts:

- Block subsidy: The amount of newly issued bitcoin entering circulation

- Transaction fees: The bitcoin fees paid by individuals to get their transaction added to the blockchain more quickly

The block subsidy is how bitcoin enters circulation.

The subsidy amount and all other supply-related rules are encoded in the Bitcoin software. The basics of these rules are as follows:

- Start at 50: At launch, the block subsidy was set at 50 bitcoin per block.

- Halvings: Every 210,000 blocks, the block subsidy is automatically reduced by half – an event known as a “halving.”

- 10-minute blocks: The Bitcoin software targets a 10-minute block time.

- Divisibility limit: Each bitcoin can be subdivided into 100 million sub-units called “satoshis” (₿0.00000001), which are indivisible.

The result of the supply rules is a type of schedule, which sets the quantity and timing of bitcoin’s supply issuance – the “supply schedule.”

How is Bitcoin’s supply schedule calculated?

Bitcoin’s supply schedule isn’t based on time, but rather on blocks.

The Bitcoin software targets block times of 10 minutes. When more computational power is deployed by miners, blocks can occur faster than 10 minutes, since more computation means increased likelihood of winning the “lottery-style” competition. To compensate, the Bitcoin software automatically re-adjusts the difficulty of mining every 2,016 blocks (called the “difficulty adjustment”) to maintain an average block time of about 10 minutes.

This means the timing of future blocks are projections, which depends on how much or little computational power is deployed by miners over time. Therefore, Bitcoin’s supply schedule doesn’t exist as a calendar with dates set in stone, but as a set of rules that take into account certain variables.

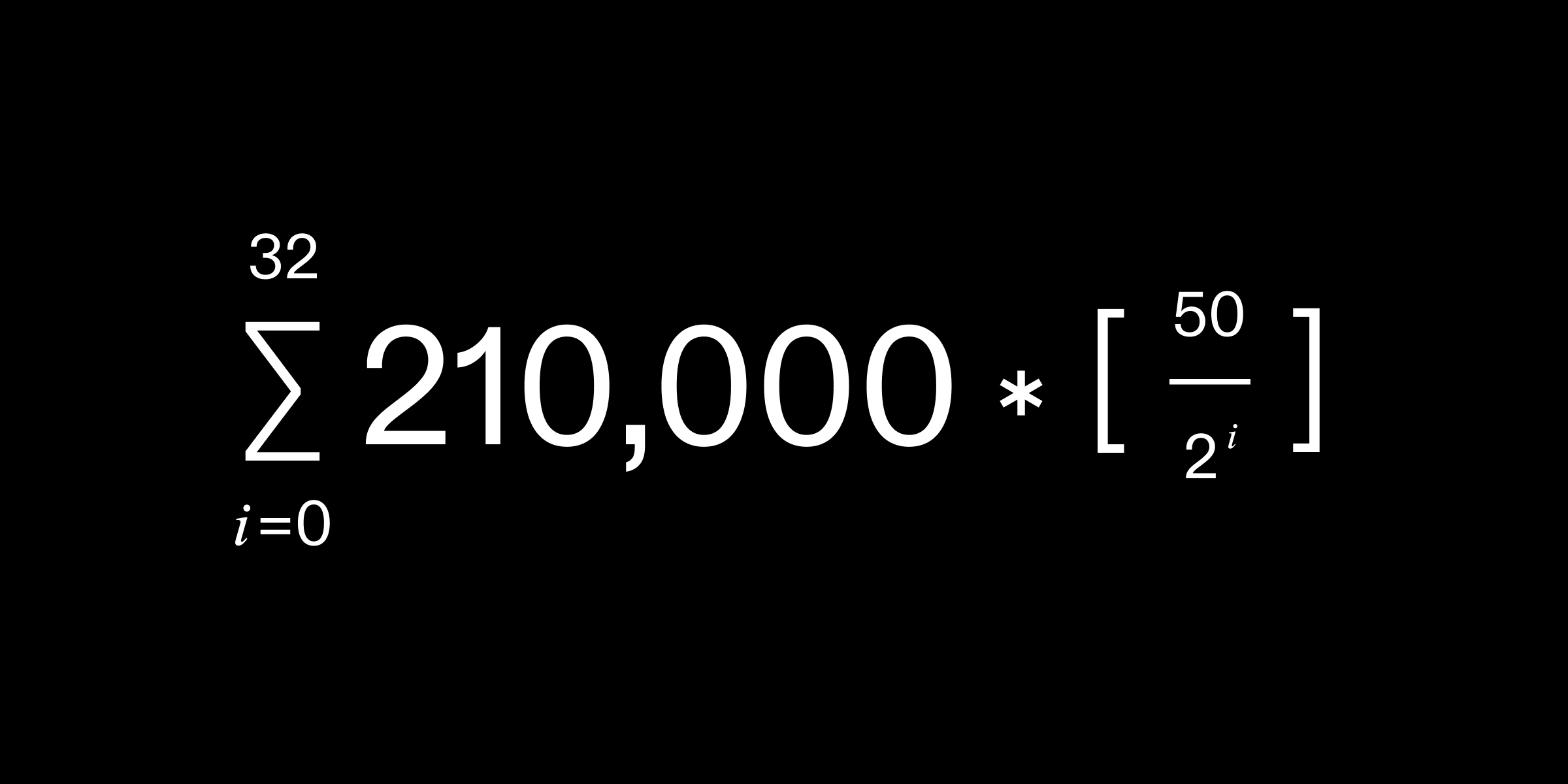

The calculation of the supply can be expressed in terms of a mathematical equation:

Let’s break this equation down into simple terms:

- ∑: This is the symbol for a summation equation

- i: The current halving cycle of Bitcoin

- 0: The initial cycle is set at zero

- 32: The number of cycle repetitions

- 210,000: The number of blocks during each cycle, or "epoch"

- 50: The maximum allowable block subsidy for the first epoch

- /2: The halving, whereby the block subsidy is reduced by half

In this formula every 210,000 blocks the cycle (“i”) increments by one, meaning the 1st epoch's maximum block subsidy is set at 50/20 (50), the 2nd is 50/21 (25), the 3rd is 50/22 (12.5), and so on. There are 33 total halving cycles, since the initial cycle starts at 0 and repeats 32 times.

When do Bitcoin halvings occur?

The exact dates of future halvings are projections, since they are based on blocks rather than time and blocks can occur slightly faster or slower than 10 minutes, depending on mining activity. Bitcoin’s supply schedule can be shown in table format.

| Year | Epoch | Halving | Block | Block subsidy | Supply at epoch’s end |

|---|---|---|---|---|---|

| 2009 | 1 | 0 | 0 | ₿50 | ₿10500000 |

| 2012 | 2 | 1 | 210000 | ₿25 | ₿15750000 |

| 2016 | 3 | 2 | 420000 | ₿12.5 | ₿18375000 |

| 2020 | 4 | 3 | 630000 | ₿6.25 | ₿19687500 |

| 2024 | 5 | 4 | 840000 | ₿3.125 | ₿20343750 |

| 2028 | 6 | 5 | 1050000 | ₿1.5625 | ₿20671875 |

| 2032 | 7 | 6 | 1260000 | ₿0.78125 | ₿20835937.5 |

| 2036 | 8 | 7 | 1470000 | ₿0.390625 | ₿20917968.75 |

| 2040 | 9 | 8 | 1680000 | ₿0.1953125 | ₿20958984.375 |

| 2044 | 10 | 9 | 1890000 | ₿0.09765625 | ₿20979492.1875 |

| 2048 | 11 | 10 | 2100000 | ₿0.04882812 | ₿20989746.0927 |

| 2052 | 12 | 11 | 2310000 | ₿0.02441406 | ₿20994873.0453 |

| 2056 | 13 | 12 | 2520000 | ₿0.01220703 | ₿20997436.5216 |

| 2060 | 14 | 13 | 2730000 | ₿0.00610351 | ₿20998718.2587 |

| 2064 | 15 | 14 | 2940000 | ₿0.00305175 | ₿20999359.1262 |

| 2068 | 16 | 15 | 3150000 | ₿0.00152587 | ₿20999679.5589 |

| 2072 | 17 | 16 | 3360000 | ₿0.00076293 | ₿20999839.7742 |

| 2076 | 18 | 17 | 3570000 | ₿0.00038146 | ₿20999919.8808 |

| 2080 | 19 | 18 | 3780000 | ₿0.00019073 | ₿20999959.9341 |

| 2084 | 20 | 19 | 3990000 | ₿0.00009536 | ₿20999979.9597 |

| 2088 | 21 | 20 | 4200000 | ₿0.00004768 | ₿20999989.9725 |

| 2092 | 22 | 21 | 4410000 | ₿0.00002384 | ₿20999994.9789 |

| 2096 | 23 | 22 | 4620000 | ₿0.00001192 | ₿20999997.4821 |

| 2100 | 24 | 23 | 4830000 | ₿0.00000596 | ₿20999998.7337 |

| 2104 | 25 | 24 | 5040000 | ₿0.00000298 | ₿20999999.3595 |

| 2108 | 26 | 25 | 5250000 | ₿0.00000149 | ₿20999999.6724 |

| 2112 | 27 | 26 | 5460000 | ₿0.00000074 | ₿20999999.8278 |

| 2116 | 28 | 27 | 5670000 | ₿0.00000037 | ₿20999999.9055 |

| 2120 | 29 | 28 | 5880000 | ₿0.00000018 | ₿20999999.9433 |

| 2124 | 30 | 29 | 6090000 | ₿0.00000009 | ₿20999999.9622 |

| 2128 | 31 | 30 | 6300000 | ₿0.00000004 | ₿20999999.9706 |

| 2132 | 32 | 31 | 6510000 | ₿0.00000002 | ₿20999999.9748 |

| 2136 | 33 | 32 | 6720000 | ₿0.00000001 | ₿20999999.9769 |

| 2140 | 34 | 33 | 6930000 | ₿0 | ₿20999999.9769 |

Some notes on the supply schedule:

- In the 1st epoch, 50% of all bitcoin were issued when the block subsidy was 50/block. Similarly, in the 2nd epoch, 25% of bitcoin were issued when the block subsidy was 25/block, and so on.

- The final “halving” that occurs in the year 2140 is actually a 100% reduction in the block subsidy, and will be the start of the final epoch, which lasts indefinitely. Bitcoin miners will henceforth be incentivized exclusively through transaction fees.

- Each halving reduces the block subsidy by exactly half up until the 10th halving, when it becomes impossible to do so, since the preceding subsidy is an odd number and satoshis are the indivisible amount of Bitcoin. As a result, the 10th halving reduces the block subsidy by 50.00000512%. In technical terms, this is due to Bitcoin using a bitwise shift operator.

- There are 10 halvings where the subsidy is reduced by slightly more than 50%: the 10th, 13th, 14th, 15th, 16th, 17th, 19th, 26th, 28th, and 30th.

- Due to certain halvings reducing the subsidy by more than 50%, the terminal bitcoin supply is actually 20,999,999.9769, which most people simply refer to as 21 million.

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)